"By the end of December, the implementation of measures adopted in the fight against and prevention of Covid-19, as well as those aimed at restoring normality, led to a reduction in revenue of 306.4 million euros and an increase in total expenditure of 7,437.3 million euros," indicates the Summary of Budgetary Implementation released by the DGO.

On the revenue side, the DGO points out the estimated impact associated to the payment exemption from the Single Social Tax (TSU), estimated at 221 ME, and the suspension of payments on account of the Corporate Income Tax (IRC), of 50.4 ME.

As for expenditure, support for companies and employment reached 4.027,6 ME, with the Apoiar programme (1.085,8 ME), support for the transport sector (1.139,5 ME), extraordinary support for the progressive recovery of activity (547,8 ME) and incentives for normalisation (409,7 ME) being the most important.

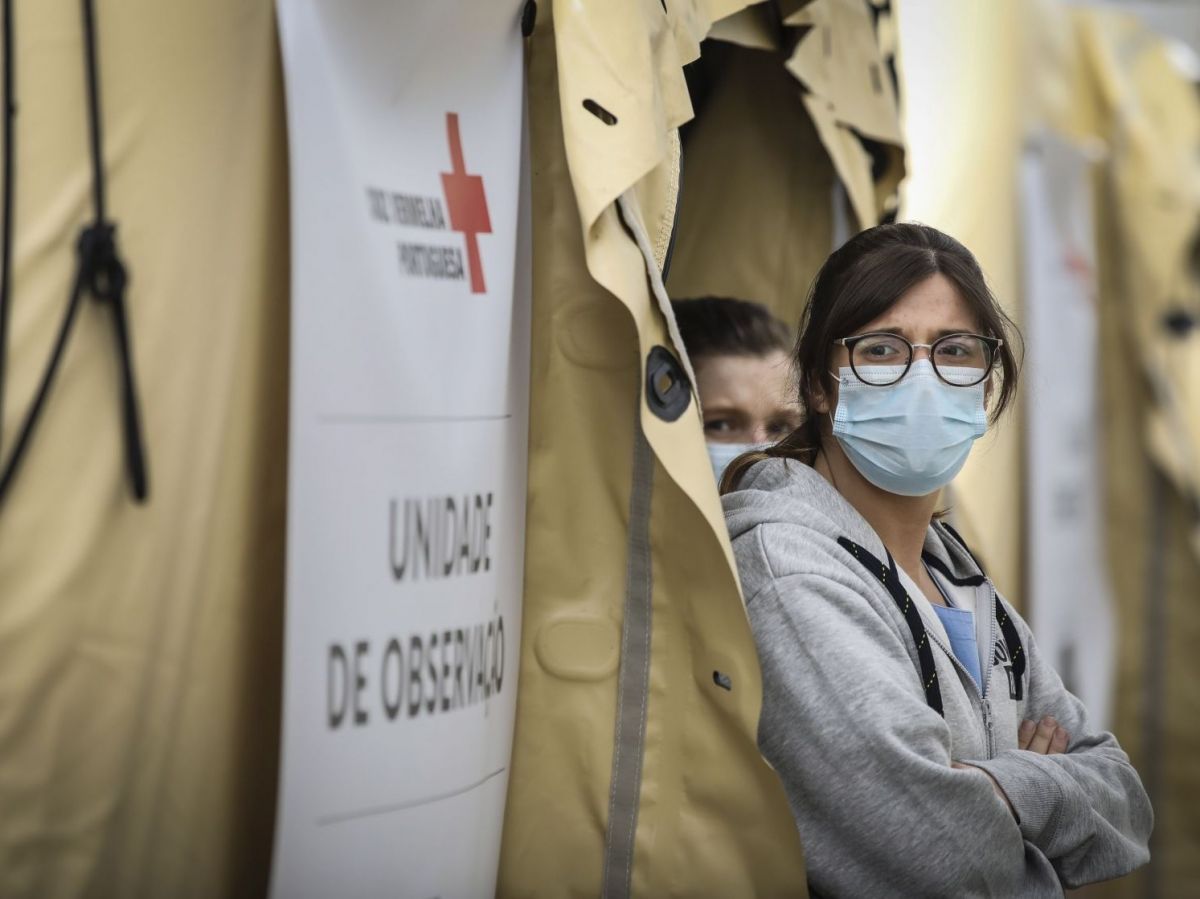

The DGO also mentions the measures in the health sector, which reached 1.474,9 ME, "namely with human resources, individual protection equipment, medicine, vaccines and tests", as well as the measures to support family income (998,4 ME), with special support for workers' income (488,4 ME).

"In the absence of the expenses associated to the measures within the scope of Covid-19, effective General Government expenditure would have grown 3.0 percent on the previous year (instead of +5.2 percent)," says the Synthesis.

Until November, the pandemic had cost the State 6,751 ME, due to an extra 6,232.4 ME in expenditure and 518.6 ME less in revenue.

Between January and December 2020, the response to the pandemic cost 4,591.1 ME, due to the loss of 1,426.1 ME of revenue and the increase of 3,165 ME in expenditure.

The data released today indicate that the state will close the year 2021 with a public accounting deficit of 8,794 million euros, an improvement of 2,862 million euros compared to 2020.